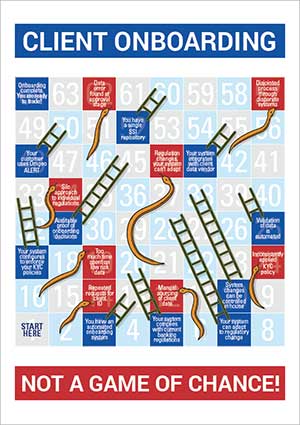

CLIENT ONBOARDING – Not a Game of Chance!

Like an unlucky game of snakes and ladders, sub-standard Onboarding and Client Lifecycle Management will see you playing on a board filled with a lot of snakes! In 2015 and beyond it is imperative that best-of-breed Onboarding and Client Lifecycle Management is a well-managed, coherent practice – not a game of chance! Make sure that your board has the ladders to success. iMeta recognises that complete Onboarding and Client Lifecycle Management presents significant operational complexity for financial services firms. The difficulty of managing onboarding operations, accurately and on time, arises from the intersection of people, process, technology and data in a multi-dimensional delivery context.

The momentous challenge of accomplishing seamless client onboarding and data management in cross-jurisdictional trading environments is now more difficult because of the profusion of global regulations. End-to-end, holistic Onboarding and Client Lifecycle Management is comprised of separate sub-activities.

Organisational Challenges

Complex, cross-functional processes across Front Office, Middle Office, Compliance and Back Office can result in:

- Repeated requests for Client data

- Manual sourcing and processing

- Too much time spent on low-risk data

- Inconsistently applied KYC policy

- Siloed approach to individual regulations

- Inability to adapt to regulatory changes

- Disjointed processes traversing disparate systems

- Data errors during the approval stage

Negative Impacts: In turn, these issues lead to:

- Poor service experience from sluggish onboarding, multiple requests for the same information, and potentially not being able to trade in time to meet business needs

- Sales teams having to interact with irate customers. Due to poor service customers may be completely lost or revenue potential may not be fully realised

- Compliance having little or no control over the implementation of policies into BAU, and the subsequent audit of compliant adherence

- Operations teams suffering from piece-meal information acquisition, regular re-work, the wrath of the Front Office and irate customers, operational inefficiency and subsequent high operational costs

Platform Capability

Capabilities across workflow management, data, rules engine and connectivity provides you with the ladders you need for:

- An automated onboarding system

- Compliance with banking regulations

- Easy adaptation to regulatory change

- In-house control over system configuration

- Configurable policies for KYC and other regulations

- Automated validation of data

- Auditable proof of process and decisions

- Data integrations for Client and SSI data

- Single repositories for Client and SSI data

Positive outcomes:

- Superior client experience resulting in improved customer service and ongoing satisfaction

- Faster time to revenue, improved upsell and cross-sell opportunities

- A highly regarded reputation delivers additional new-to-bank sales

- Responsible teams and individuals are able to track adherence to policy and provide demonstrable audit of regulatory compliance

- Greatly increased operational efficiency, an enhanced operational control model, less manual work and reduced costs

- Data management architecture simplified by a single platform with both upstream and downstream connectivity

- Data quality management is now automated

- Reduced overall technology costs

- No upfront enforcement or compliance checklists

Choosing the Ladders! Delivered on a single platform, iMeta’s client-centric workflow enables horizontal linking of onboarding, compliance and data management activities across the full lifecycle. Efficient, cost-effective, compliant, revenue generating and customer focused data management makes this an inescapable imperative for 2015 and beyond!